If young people delay gratification and start saving from the minute they have an income, they will have a superb retirement, shares The Financial Planning Association of Malaysia (FPAM). THE Certified Financial Planner Board of Standards states: “Financial planning is the process of meeting your life goals through the proper management of your finances.”

Retiring well or better yet retiring in style is a crucial life goal. Securities Commissionlicensed financial planner Ken Lo of Money Concepts Corporation says, “The minimum basic requirements for a comfortable retirement are:

1. A debt-free residence;

2. A few sources of passive income to maintain lifestyle;

3. A long-term care programme;

4. Adequate life insurance;

5. A few good friends;

6. Regular family gatherings; and

7. Being in reasonably good health at least until the age of 75.”

»Retirement funding is often intimidating once real numbers are crunched. But those who proactively face this reality early on are more likely to survive than those who stick their heads in the sand!« RAJEN DEVADASON

|

Today, we’ll look at two case studies of young working adults, Alex and Betty. Alex is 25; his 24-year-old girlfriend is Andrea. She doesn’t know it yet but Alex is going to propose to her the moment you finish reading this article!

Individuals like Alex and Andrea, young working adults who plan to marry, face the immediate challenge of meeting wedding expenses.

According to retirement specialist Rajen Devadason, “The difficulty such lovebirds face is balancing urgent near-term goals like getting married against long-term ones like funding a superb retirement.”

A miscalculation in the expenses associated with a fancy wedding can lumber some young married couples with a load of debt that lingers for many years. The interest on such debt as well as the diverted cash flow to repay the principal sum borrowed reduces the total number of future ringgit available for retirement funding.

Tan Beng Wah, CEO of CIMB Wealth Advisors, notes, “People in their 20s rarely think about retirement; they feel there is a long way to go. But it’s advisable they initiate retirement planning now; even if it’s with a small amount because they can capitalise on the compounding effects of their investment portfolio.”

Devadason, a Securities Commissionlicensed financial planner, points out, “Most young couples like Alex and Andrea eventually plan to have children; so, a long-term goal they must prepare to fund is the tertiary education of their unborn kids.”

Bear that in mind as we move on to our second case study, Betty. She’s a 24-year-old who is contentedly single. Logically speaking, people like her should find funding retirement easier than couples such as Alex and Andrea.

However, a major pitfall for young, confirmed bachelors and bachelorettes is the erroneous, entrenched belief that forced EPF savings will be sufficient to meet all eventual retirement needs.

Also, without the countervailing priorities of looking out for a spouse’s best interests and caring for children who may come along, some single people become enmeshed in wealth-sapping yuppie choices like too frequent overseas holidays and costly designer clothes that burn up cash.

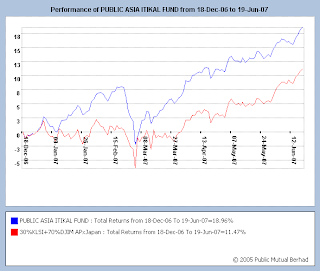

The two accompanying charts suggest how appropriate retirement funding plans might be structured for Betty and Alex. As Betty is just at the starting blocks of her career, her monthly salary is probably below RM2,500. In fact, it’s likely she’s struggling to make ends meet on a net pay package of perhaps RM2,000 (after EPF and Socso deductions; at that salary level she is not subject to tax deductions). In time her income is expected to rise, but for now we’ll assume Betty maintains her lifestyle on RM1,800 a month and is able to ferret away RM200 a month in savings.

In planning for her distant retirement, we’ll make 12 assumptions:

1. She would like to maintain a RM2,000 (in 2007 terms) lifestyle throughout her retirement.

2. She will retire at 55. As she’s 24, that leaves 31 years to retirement.

3. She comes from sturdy stock and believes she should live beyond 85. For planning purposes, we shall assume she survives until the age of 90 in 2072. As she will retire at 55, she will spend a projected 35 years in retirement.

4. Between now, 2007, and the year she retires, 2038, inflation (meaning her personal inflation rate as opposed to the official CPI rate) runs at an average of 4% a year. (By her first year of retirement, it will cost RM80,956 in future 2038 ringgit terms to afford a RM24,000 a year lifestyle.)

5. From a psychological perspective, we’ll also assume she has a moderate appetite for risk. This might mean she would be comfortable with a retirement funding portfolio comprising bank savings in the form of fixed deposits and unit trusts encompassing money market funds, bond funds, domestic equity funds and international equity and property funds. If such a pre-retirement portfolio is regularly rebalanced, it should yield an average compounded growth rate (CAGR) of 8%.

6. Once Betty retires at the age of 55, her active income flow will cease. This means her ability to accept investment risk will plummet. As such, the inherent volatility (aka investment risk) of her retirement funding portfolio should be geared down. Here, we’ll assume a reduction in the equity portion and a corresponding increase in her allocation of safer bonds. The new lower targeted CAGR of the revised retirement portfolio is 6%.

7. Throughout her anticipated long retirement stretching 35 years, medical expenses, which tend to rise faster than general expenses, will form an increasingly chunky portion of her total cash outflow profile. So, here we’ll assume the inflation rate averages 5% during retirement.

8. If we take all this into account, then based upon a capital liquidation method, a total of almost RM2.4mil is needed to fund her retirement. (Note: Betty’s EPF savings at 55 may amount to a few hundred thousand ringgit — a sum NOT taken into account in this analysis, which should thus provide an added cushion of safety for her.)

9. Because we assumed earlier Betty will earn an 8% yield on her portfolio, this means she would need a much smaller total theoretical sum of personal savings today to compound over 31 years to grow to RM2.4 million. Crunching the numbers shows the theoretically required amount is RM220,836.

10. However, we assume she has nowhere near that sum today. Instead, we’ll assume she has RM5,000 in savings with which to start her personal retirement planning fund.

11. Thus her current one-shot shortfall is RM220,836 minus RM5,000 or RM215,836. The handy retirement planning software used for this analysis indicates an annual investment of RM19,017 will achieve that target.

12. Thus it seems Betty needs to set aside more than RM1,500 a month — on average between now and when she retires — to meet her retirement funding needs. At the moment, this is patently impossible as she brings home RM2,000 a month, lives on nine-tenths of that and, initially at least, saves only RM200 per month.

For Betty to meet her longterm personal retirement funding needs, she’s going to have to work at increasing her income while learning to exercise one crucial personal discipline. According to Michael Tan Lib Chau, CEO of RHB Unit Trust Management, “That discipline involves the principle of delayed gratification.”

He shares this example, which might apply to Betty a decade or two down the road: “If she earns RM8,000 and receives an increment of RM2,000, she shouldn’t begin living like someone earning RM10,000 but should invest between RM2,000 and RM3,000 in an area of profitable return.”

Let’s now leave Betty and look at Alex’s situation, which includes taking into account his soon-to-be bride Andrea’s needs.

In their case, we’ll assume each earns a net monthly income after EPF and SOCSO deductions of RM2,000, just like Betty. But in this case, because they will soon be married, this brings their total net household income to RM4,000 a month or RM48,000 a year.

In planning for their retirement, we’ll make these 12 assumptions:

1. Alex and Andrea would like to maintain a joint RM3,500 a month or RM42,000 a year (in 2007 terms) lifestyle throughout their retirement.

2. Because they plan on having kids, the first 25 years of married life may necessitate saving and investing for the tertiary education needs of those children. From a practical standpoint this may require both choosing to work beyond the currently conventional retirement ages of 55 or 56 to permit more time to ‘play catch-up’ on their retirement needs. We’ll assume both work until Andrea is 59 and Alex is 60. Thus, they have 35 years to retirement.

3. International longevity studies indicate married couples live longer than singles. Here we’ll assume both Alex and Andrea plan for a retirement that extends until he turns 91 and she turns 90, in 2072. They anticipate having 35 years to prepare for a 31-year retirement period.

4. Between now, 2007, and the year they retire, 2042, their personal inflation rate is 4%. (By the time they reach their first year of retirement, it will cost RM165,736 in future 2042 ringgit terms to afford a current RM42,000 a year lifestyle.)

5. In this example, we shall further assume Alex makes the primary investment decisions and that he has a high or aggressive appetite for investment risk. So, while Alex and Andrea also build a retirement funding portfolio comprising the same instruments as Betty, its equity weighting is higher while its money market and bond weightings are correspondingly lower. Here we’ll assume their regularly rebalanced pre-retirement portfolio yields a CAGR of 9%.

6. Once they retire, their rebalanced ‘geared down’ retirement portfolio will have a target CAGR of 7%.

7. Like Betty, accelerating medical expenses suggest it’s wise to target a retirement inflation rate of 5%.

8. Bearing all this in mind, a target sum of just under RM3.9mil, based on a capital liquidation method, is required. (Also, both of them may have perhaps RM500,000 in total EPF savings that can be used to provide an additional cushion of savings in retirement.)

9. As we assumed they will earn 9% a year on their preretirement portfolio, discounting the target ‘size of fund needed at retirement age’ back to today by

9% indicates they will need a lump sum of RM188,759 in today’s ringgit to fully fund their plan.

You may notice this amount is about 15% less than Betty’s corresponding required lump sum.

This oddity arises for two reasons: Alex and Andrea are projected to earn 9% on their portfolio against Betty’s 8%; and they have four additional years of compounding to boost their retirement funds.

10. Because they’re likely to use most of their current savings on their impending wedding, we’ll assume here they have only 20% of Betty’s RM5,000 in savings, namely RM1,000, to begin their joint personal retirement planning fund.

11. Their theoretical initial funding shortfall is RM188,759 minus RM1,000 or RM187,759.

If all the assumptions above hold true, then some rather intimidating number crunching suggests an annual investment sum of RM17,769 is needed for them to meet their retirement funding target. (Again note this sum is lower than the RM19,017 Betty needs to invest each year because of Alex and Andrea’s higher level of accepted portfolio risk and the longer time they have opted to give themselves to accumulate funds and compound wealth!)

12. So, Alex and Andrea need to set aside just under RM1,500 a month — again, on average between now and retirement — to meet their retirement funding needs.

Since they currently can save only RM500 (RM4,000 minus RM3,500) per month, the best they can hope to do is exercise delayed gratification in the decades ahead and steadily expand their savings rate.

Such analyses are sobering. Alfred Sek, CEO of Standard Financial Planner, says, “I always advise young people to adopt a “save first and spend the balance” approach, not a more common “spend first and save the balance” approach. There is no limit to possible spending, and that’s why in most cases there is nothing left to save.”

Devadason adds, “Retirement funding is often intimidating once real numbers are crunched.

But at least those who proactively face this reality early on are more likely to survive, or better yet thrive, than those who decide to stick their heads in the sand!”