How does it work?

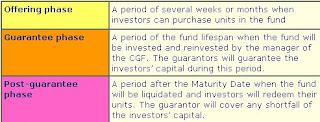

A CGF typically consists of three phases:

The guarantee factor

Let’s assume that you bought units in a CGF at an Initial Selling Price of RM0.50 per unit. The fund maturity period is three years. You invested RM5,000 in exchange of 10,000 CGF units. When the maturity date arrives, the net asset value of the funds is only RM0.40 per unit. Since it is a CGF, you will receive RM0.50 per unit when you redeem your fund, instead of RM0.40 per unit. Basically, the guarantor of the fund will pay for the RM0.10 difference. In this case you will receive RM5,000 after redeeming the 10,000 CGF units. Without the guarantee you would have lost RM1,000 and would only receive RM4,000 (excluding fees and charges).

However, if on the maturity date the net asset value per unit is RM0.60, the guarantee will not be triggered and the redemption value of each unit will then be based on the actual net asset value per unit of the fund. In this case, you will receive RM0.60 per unit rather than RM0.50. Therefore you will receive RM6,000 for redeeming your 10,000 CGF units (excluding fees and charges). Your profit is RM1,000.

Nonetheless, the guarantee is only applicable for units that are held until the Maturity Date in this example, three years. If the units are disposed before the Maturity Date, the guarantee will lapse and investors’ capital will no longer be guaranteed and will be exposed to potential capital lost. For some CGF, penalty will be imposed for early redemption. You must consider all these factors to ensure that investing in the CGF is consistent with your investment plan.

Risks and benefits

* Even though the SC’s Guidelines on Unit Trusts requires the guarantor to have a good credit rating from either domestic or global rating agency, there’s always the risk of default by the guarantor.

Capital preservation is the main feature of CGF but it should not be the sole basis for making your decision to invest in the product. Like any other investment products, CGF comes with investment risks too. Therefore, you should review your financial goals first and subsequently, evaluate the CGF offer thoroughly, to ensure that both are consistent before you invest. You should also review the fees structure of the CGF imposed by the manager of the fund, because these fees could affect your investment returns and will be deducted from your capital.

Source: Securities Industry Development Centre (SIDC)

No comments:

Post a Comment